COVID-19 Week Six Update

/Last week was an eventful one for investors and in the US in general. In the coming days and weeks, we will see policymakers and officials make difficult decisions based on the information that is starting to come out—both in the numbers of COVID-19 cases and deaths and quarterly economic numbers.

US jobless claims topped 5.2 million last week, which brings the total to 22 million in the past four weeks. Getting the jobless back to work will become a main topic of discussion as local and state governments weigh continuing current stay at home guidelines vs lifting these orders.

You may have seen that Tennessee governor Bill Lee has suspended public schools for the remainder of the 2019-2020 school year. This decision is being made in school systems across the country. From a personal perspective, this has been difficult for families and school staff—to leave for Spring Break and not come back without saying goodbye to friends and teachers has been hard. Colleges continue with classes and will be moving on to final exams in the next week or two. Right now, universities are making contingency plans for the fall in case students cannot come back to campus.

As a follow-up to our update from last week on the CARES Act, the Payroll Protection Program (PPP) loan provision of the Act was funded with $349 billion to help small businesses keep their employees on the payroll. That $349 million ran out of money last Thursday before many of the applications made it to the Small Business Administration for review. It is expected that Congress will approve another $400 billion for the program this week.

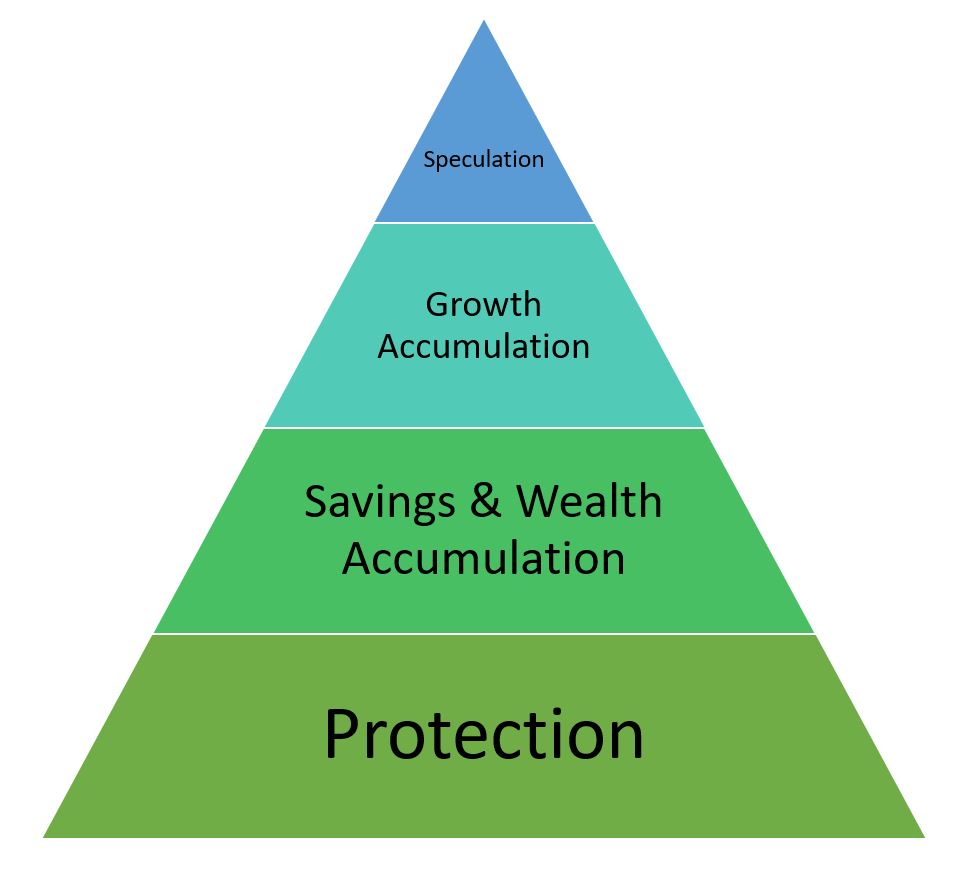

The stock market continued its recovery off the March lows. We will more than likely have more volatility in the coming months, so we should prepare to see more ups and downs. As advisors, we are sometimes asked the question, “If you think the market may come down, why don’t we liquidate and get back in when the market is lower?” The boiled-down answer is for one, the market may not go down. Secondly and more importantly, is where do we get back in? This can prove to be a difficult decision for investors and advisors. Often there are tax and other considerations involved as well.

Again, we recommend our clients stay invested and stick with their original investment plans. Our goal during this time continues to be communicating with you and discussing issues you feel may impact your financial goals. As always, thank you for your continued confidence, and please contact us any time we can be of assistance.

The CrestPoint Wealth Management Team